10 Reasons Why "Waiting" To Buy Silver Stocks Is A Huge Mistake

By Max from OneStock Nov 27, 2019

The fact of the matter is that Silver is primed to go higher. The video above does a pretty good job of explaining why. But it doesn't give you the total picture.

The good thing is, as an investor, you don't need to know all the reasons. You just have to be on board when one of those reasons happens to spark a huge rally in Silver stocks.

And for that to happen, it all comes down to one thing. Supply and Demand.

Fact 1: Silver has been consistently rising in demand.

Fact 2: There's not enough silver to fulfill that demand.

These two facts alone mean that a big move in Silver is virtually inevitable. And we're already seeing many signs that it's already getting started.

So how do you play this move as an investor?

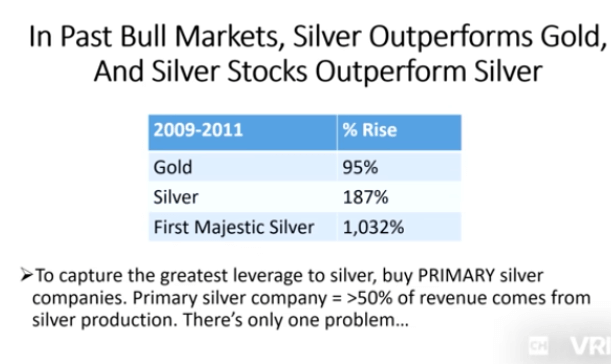

Here's a little tip on how to pick the right silver stocks. This is a slide from Jeff Clark's phenomenal talk at the last Vancouver Resource Investment Conference....

Here’s a few things you need to know about Aftermath Silver before you add it to your portfolio:

They’re based in Chile - Chile is one of the safest, most politically stable regions for mining. In fact it’s economy was built on Silver way back in 1853. Unlike some other countries they love miners and protect their operations religiously.

They have a highly experienced team with many mining successes under their belts already. Their roster is too long to list here, but you can check their website to see that these folks are the real deal.

As far as properties go, they currently have two fantastic projects...

#1 The Chalocallo Property - Challacollo silver project, has a 37 million-ounce high-grade silver historic resource. . The property comes with a substantial potential to add ounces. Underground sampling suggests a potential 20 million ounces ignored in the latest resource estimate.

#2 The Cachino Property - The Cachinal property and has a current NI 43-101 silver resource of just over 22 million ounces. Aftermath is paying a total of $3 million for the project over a three-year period. That works out to about CA$0.15 per ounce of silver.

Right now the spot price of silver is around CA$23.00 per ounce. Of course there are costs to get it out of the ground. Yet the potential is huge for Aftermath and whoever is quick enough on the draw to get in on the ground floor.

Whatever you decide, make sure you don’t let the Silver boom take you by surprise.

I’ve got a feeling Silver is going to catch a lot of people off guard. Recently David Morgan said “People will flock to $30 silver”. I think he’s more right than he knows. And it could be sooner than we think.

People complicate investing when there’s really no need to. If you want to make money in stocks, it’s simple. You buy when sentiment is low. And sell when it’s high. Sentiment is still at an all-time low on Silver. And if you need more convincing I can think of no better way than to direct you to the Jeff Walker talk.

He actually mentions some silver plays in there at the end. But at the time of this video Aftermath wasn’t around. You’ll see how it meets all his criteria and more…. And actually how it’s likely the better pick than even his recommendations.

As always, thanks for taking some time to read this article. Don’t forget to share this post with anybody you think would benefit from it. And make sure to subscribe to my email list below to get my picks before I post them here on the site.

If you've been thinking about dipping your toe into precious metals, and Silver stocks have been on your 'maybe' list. You might want to think about jumping in sooner rather than later.

Because once Silver leaves the station, it will be really hard to pick up any quality Silver stocks at the huge discounts that we are seeing right now. .

So without further adieu....

Here are 10 little-known facts that could cause the silver market to absolutely go ballistic in 2020 and beyond.

If you want to maximize your gains, then look to buy stocks that will benefit the most from a rising price in silver. Look for companies that are heavily weighted towards Silver.

And to be honest, there’s really not a lot of Silver companies like that out there. Pure silver plays are very rare these days.

One that does fit the bill however is Aftermath Silver Ltd. It’s a newer company and has just hit the TSX Venture exchange under the ticker symbol AAG. It also trades in the US on the OTC markets as FLMZF. (Update Jan 10, 2020 Aftermath has a new ticker for US investors... AAGFF Click here for the latest chart)

Aftermath is one of the few Pure Silver players in the market and it’s definitely worth taking a look at.

Even legendary investor Eric Sprott has just taken a huge position it. This has turned a lot of heads not only to Aftermath but to the Silver market as a whole.

I profiled it a few days ago in an article about Electric Vehicles. So if you’re interested in learning more about Aftermath take a look at that article by clicking here or you can visit Aftermath's corporate website here.